But with the rapid increases in the policy interest rate by the Bank of Canada since March 2022, variable-rate mortgage borrowers have faced historically large interest rate increases that make reaching their trigger rate a significant possibility.

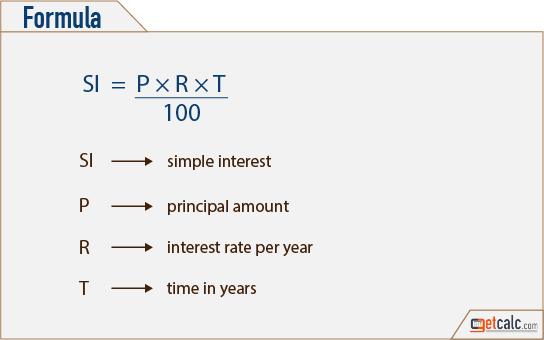

Interest rates have remained low since the global financial crisis, so few borrowers over the past decade have experienced a situation where the trigger rate has been reached. Each borrower with a variable-rate mortgage with fixed payments is subject to an individualized trigger rate, which is specified in their mortgage contract. 4 If interest rates increase beyond the trigger rate, the amount required to cover the interest payment will be more than the mortgage payment. Therefore, if the prime rate rises, the interest portion increases and the principal portion decreases, while the total payment remains fixed.įor variable-rate mortgages with fixed payments, the trigger rate is the interest rate at which the interest portion of the payment equals the total payment amount, and therefore the principal portion is zero. 3 Although the total payment amount remains constant, the interest portion of the payment varies with the prime rate, and the residual amount goes to principal. For a variable-rate mortgage with fixed payments, the payment amount is calculated at the beginning of the contract and remains the same for the duration of the loan term.For a variable-rate mortgage with variable payments, the size of regular payments fluctuates as the prime interest rate changes-if prime rates go up, the mortgage payment increases to cover the larger interest component.In Canada, major lenders generally offer variable-rate mortgages with either variable or fixed payments: 2 As such, our findings represent an upper-bound estimate. However, this calculation does not account for any actions borrowers may take or have already taken to lessen the effects of reaching the trigger rate. This share will rise if banks’ prime rates increase further. Of borrowers with a variable-rate, fixed-payment mortgage, we estimate that about 50%-or nearly 13% of all Canadian mortgages-have already reached their trigger rate. In this note, we examine the concept of trigger rates more closely and discuss what usually happens if a borrower reaches their trigger rate. For some households, this payment increase may be unexpected. If rates rise above the trigger rate, borrowers may then need to increase their mortgage payment to cover the additional amount of interest.

The interest rate at which this happens is known as the trigger rate. But if interest rates increase substantially, these mortgage borrowers may reach a point where their fixed payments cover only interest and not any principal. 1 For these specific mortgages, when interest rates move, the amount of the mortgage payment does not change, but the portion going toward interest (rather than principal) is adjusted. In Canada, about three-quarters of variable-rate mortgages have fixed payments. These types of mortgages now account for about one-third of total outstanding mortgage debt, up from about 20% at the end of 2019. As a result, many borrowers opted for a variable-rate mortgage. For most of 2021 and into early 2022, variable mortgage rates were substantially lower than fixed mortgage rates.

0 kommentar(er)

0 kommentar(er)